direct vs indirect cash flow gaap

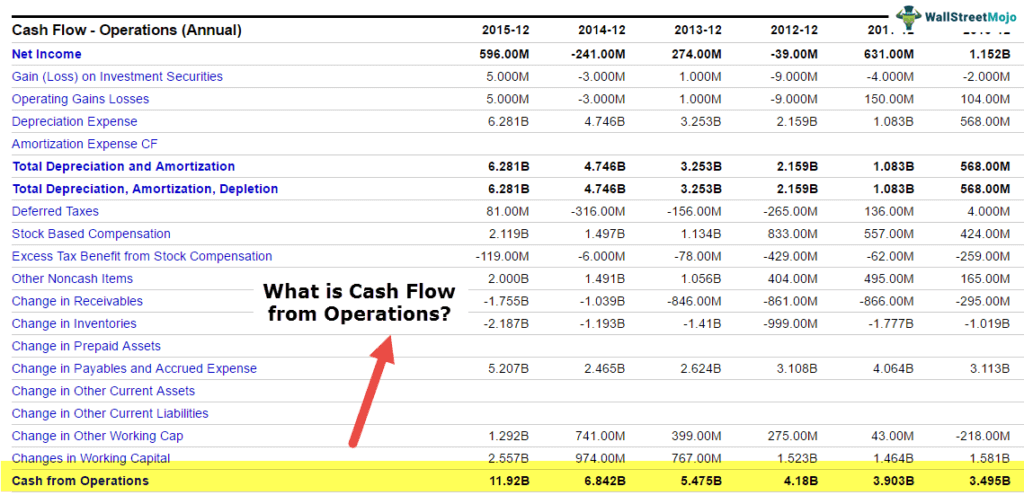

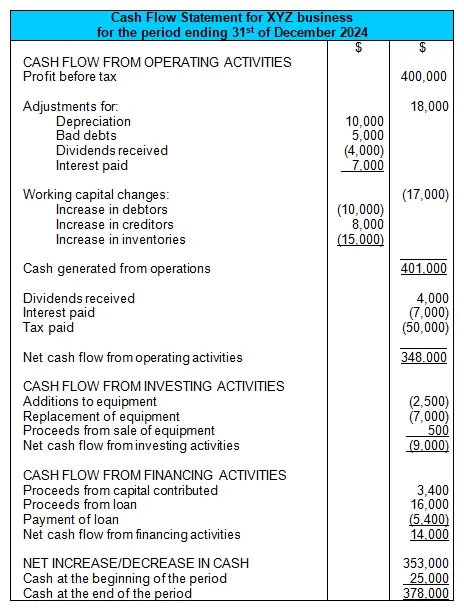

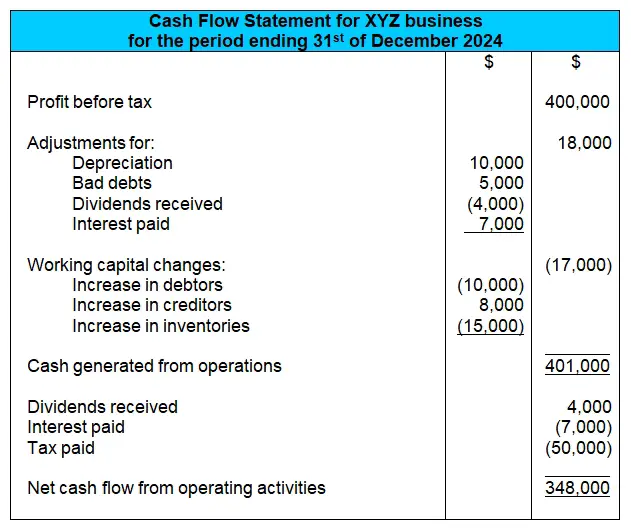

Indirect method is the most widely used method for the calculation of net cash flow from operating activities. The following are the common types of adjustments that are made to.

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Indirect cash flow discussion is the use of accounting software to keep things organized.

. Under US GAAP defined benefit pension plans that present financial information under ASC 960 3 and certain investments companies in the scope of ASC 946 4 may be exempt from presenting a statement of cash flows. Under US GAAP defined benefit pension plans that present financial information under ASC 960 3. Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities.

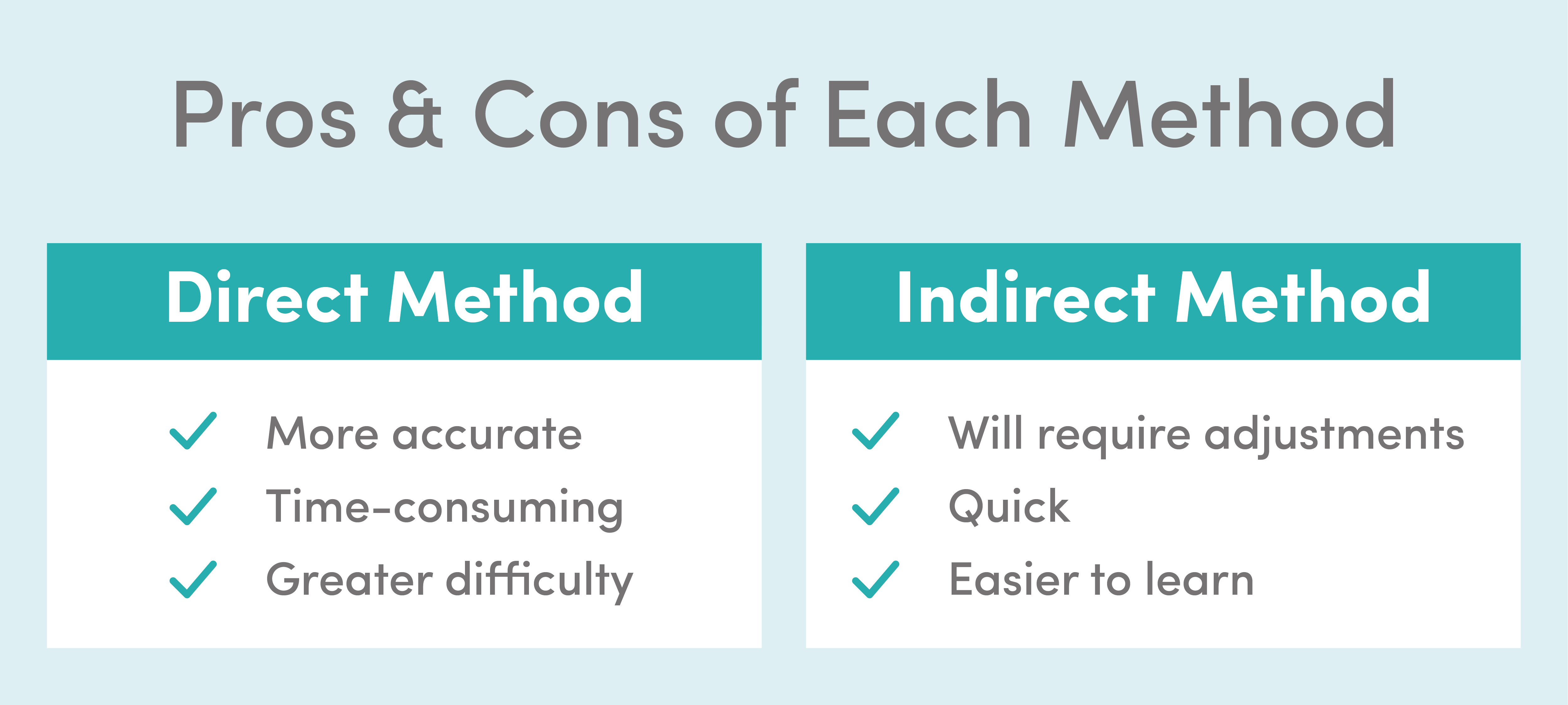

The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. US GAAP also requires similar adjustments.

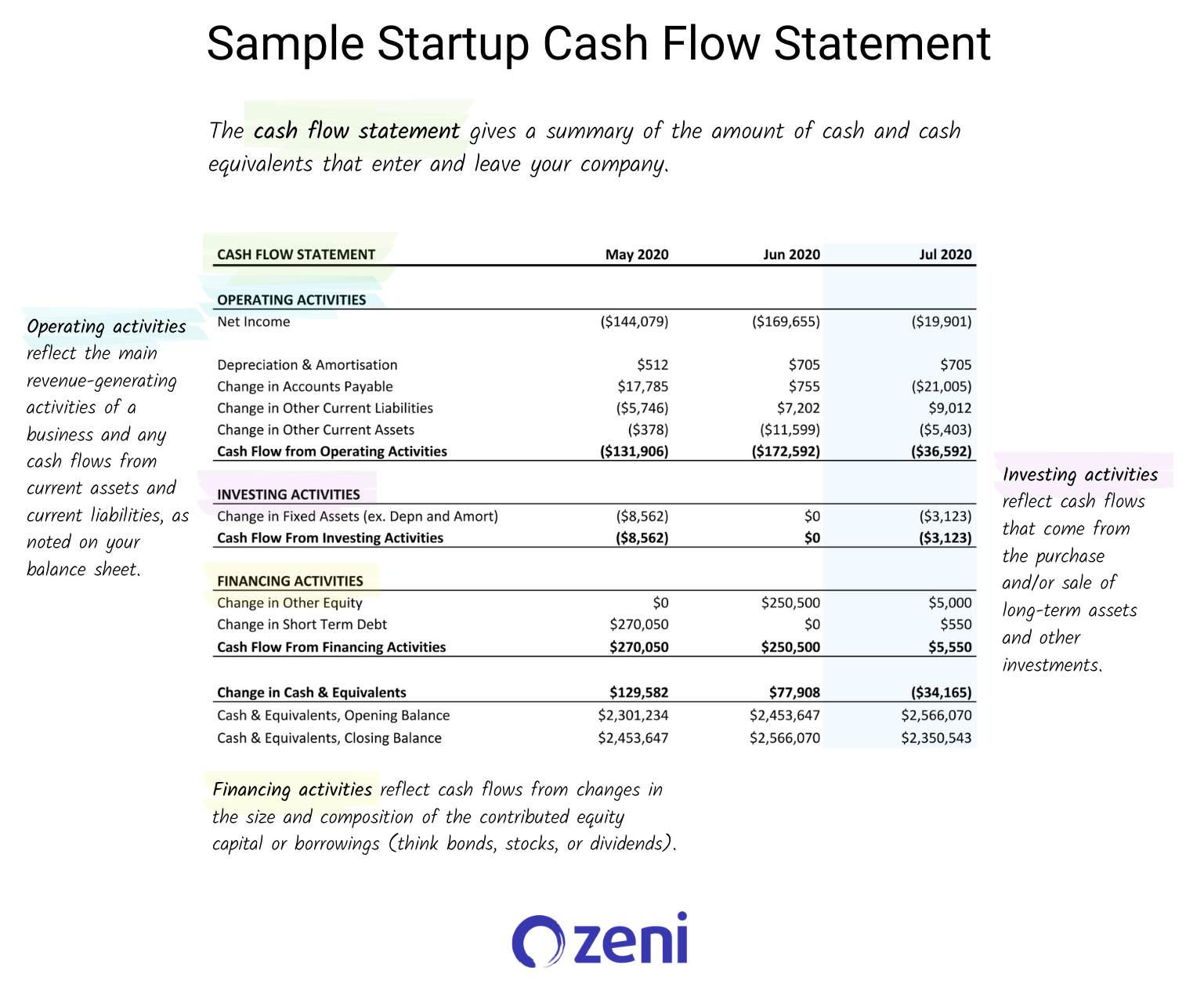

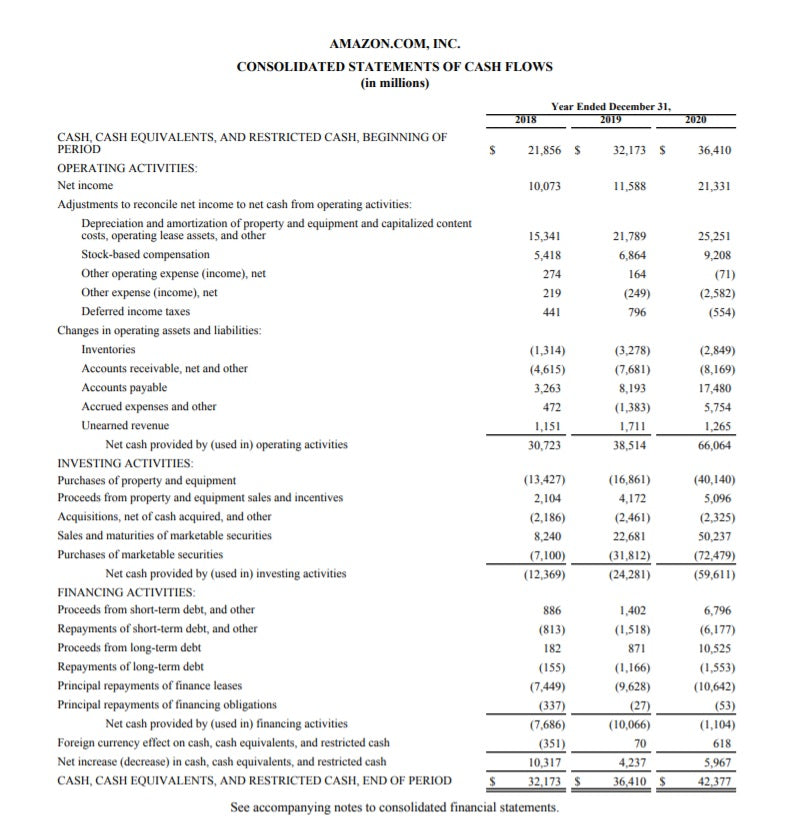

Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used. Statement of cash flows Subject. There are two different methods used to create a cash flow statement.

Indirect costs should also be included in the derivation of a products price when setting long-term rates where product sales must cover both direct and indirect costs. 106 Both encourage the use of the direct method. For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid.

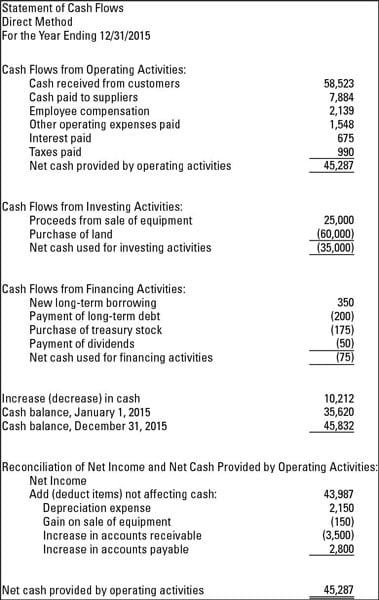

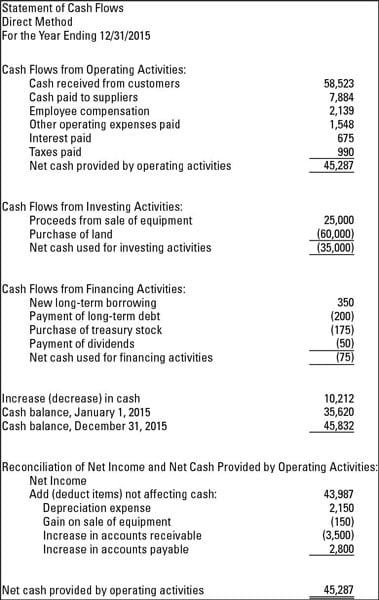

Under IFRS Standards there are no scope exceptions and all companies must present a statement of cash flows in a complete set of financial statements. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. The direct method takes various cash activities receipts from customers.

The investing and financing categories are treated the same under both methods. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Chances are if you are in business you use both direct and indirect cash flow to report your net.

108 In addition unlike IFRSs US. The difference between the two methods only affects the cash flow from the operations section. The starting point of the.

Currently more than 120 countries require or permit the use of International Financial Reporting Standards IFRS with a significant number of countries requiring IFRS or some form of IFRS by public entities as defined by those specific countries. Direct cash flow forecasting relies on the companys cash collections and disbursements to calculate cash flow. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

GAAP requires a reconciliation of net cash flow from. Direct expenses include things like payroll costs and rent while indirect expenses could include equipment-related costs such as insurance or depreciation as well as sales which Direct vs Indirect Cash Flow are still in accounts receivable. To perform this calculation begin with net income add back non-cash.

Both the Direct and Indirect methods require that cash flows be classified into three categories. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses.

However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. The direct method for direct cash flow statements and the indirect method to create an indirect cash flow statement.

However of the two the direct method is generally encouraged. Generally Accepted Accounting Principles GAAP and. Statement of cash flows always required under IFRS Standards.

Also if a company. The cash flow direct method on the other hand records the cash transactions separately and then produces the cash flow statement. 95 permit the direct and the indirect method of reporting cash flows from operating activities.

Exceptions exist under US GAAP. GAAP also calls the indirect method the reconciliation method. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business.

Cash flows thereby reducing the diversity in practice described above. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. Direct and Indirect Method for a Manufacturing Entity 230-10-55-10 The following is a statement of cash flows for the year ended.

Example 1. Statement of cash flows Keywords. Interest received must be classified as an operating activity.

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Operating investing aka discretionary and financing. An important point in the direct vs.

Operating activities however are treated very differently. Eventually youll need to switch to indirect cash flow forecasting as your company expands.

Statement Of Cash Flows Indirect Method Format Example Preparation

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect The Best Cash Flow Method Vena

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Statement Of Cash Flows Direct Method Format Example Preparation

How To Read A Cash Flow Statement Zeni

Everything You Need To Know About A Cash Flow Statement 2022

Direct Vs Indirect Method Statement Of Cash Flows Youtube

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Indirect Cash Flow Statement Method

The Indirect Cash Flow Statement Method

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Methods For Preparing The Statement Of Cash Flows Dummies

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal